Uniswap is just one of the largest decentralized crypto exchanges. It enables you to swap cryptocurrency symbols easily, as well as you do not have to sign up for an account. You can also earn interest on your crypto holdings through Uniswap’s liquidity swimming pools. Nonetheless, this exchange is afflicted by high charges. Review our complete Uniswap testimonial to find out about its benefits and drawbacks.

Full Uniswap evaluation

This cryptocurrency exchange is a great fit for: Traders with a crypto pocketbook who want to switch symbols or earn passion with crypto staking.

Pros

- Swap ERC-20 tokens

- User-friendly design

- Earn interest by staking crypto

- No registration required

- Crypto wallet support

Cons

- Doesn’t accept fiat money

- High gas fees

- Risk of impermanent loss

- No KYC

How Uniswap works

Uniswap is a sort of decentralized exchange known as an “computerized market manufacturer” (AMM). AMMs make use of smart contracts (programs composed on the blockchain) to establish costs and carry out professions. Considering that they’re decentralized, these exchanges do not have a main regulating body handling orders. They’re able to provide decentralized monetary solutions, generally referred to as DeFi.

AMMs like Uniswap can give crypto trading due to their liquidity pools. A liquidity swimming pool is a swimming pool of crypto funds, contributed by customers, secured a smart agreement. Funds from the liquidity pool are utilized when individuals intend to trade crypto.

Uniswap takes a tiny fee from every purchase and also distributes it among a swimming pool’s liquidity carriers (individuals that have actually transferred their crypto into the pool). It’s a mutually beneficial connection. Uniswap has the ability to supply crypto trading as a result of its liquidity suppliers, as well as its liquidity companies make crypto because they all obtain a cut of the exchange’s purchase fees.

How to use Uniswap

To use Uniswap, you attach your crypto wallet. After you do that, below’s what you can do on the exchange:

Profession crypto: Pick the “Swap” alternative, after that choose the crypto you wish to trade as well as the crypto you wish to receive.

Risk crypto: Choose the “Pool” option. You can open up a new position and down payment any 2 cryptos that have a Uniswap swimming pool currently. You can likewise take a look at the top pools if you’re not sure which cryptos to stake.

There are a lot of complimentary crypto budgets offered, with MetaMask, Trust Fund Wallet, and also Coinbase Budget all popular alternatives. As soon as you have a purse, you can generate an address and send your crypto to it. After that, you can trade or risk that crypto on Uniswap.

Leading advantages

Swap Ethereum-based symbols

On Uniswap, you can rapidly trade any kind of electronic possessions suitable with Ethereum (frequently described as “ERC-20” assets). Given that several cryptocurrency symbols are created using Ethereum, there are numerous kinds of cryptocurrency you can trade on this exchange.

User-friendly style

Some crypto exchanges have clunky styles and a lackluster customer experience. Uniswap was one of the first preferred decentralized exchanges in large component due to its design.

The Uniswap application is really user-friendly, so it doesn’t take long to find out just how it functions. It’s simple to attach a crypto wallet, swap one crypto for an additional, or deposit your crypto in a liquidity swimming pool.

Earn interest by laying crypto

Because it’s a decentralized exchange, Uniswap operates on crypto funds from its customers through liquidity swimming pools, which are pools having 2 cryptocurrencies. Anyone can risk (deposit) cryptocurrency right into these pools and end up being a liquidity service provider. Uniswap charges a tiny charge on every crypto profession, and also distributes that charge amongst all the liquidity providers for those 2 cryptocurrencies.

Here’s an example to demonstrate how this works. Allow’s state you own USD Coin (USDC) as well as Ethereum (ETH). You could transfer equal amounts of each crypto to Uniswap’s USDC/ETH liquidity swimming pool. Then you gain crypto whenever a person swaps ETH and USDC on Uniswap.

DISCOVER MORE: What Is Betting in Crypto?

Enough liquidity

Liquidity is very important for decentralized crypto exchanges. They require plenty of crypto funds to satisfy professions. A decentralized exchange that’s short on funds is bad for investors and liquidity carriers. Investors may not have the ability to exchange the cryptocurrencies they want. Less trades implies less charges, and the exchange’s liquidity suppliers do not gain as much.

This is where Uniswap’s size is a substantial benefit. It is among the biggest decentralized exchanges in terms of overall worth secured (TVL)– the amount of crypto funds in its liquidity swimming pools. Whether you intend to trade crypto or make interest as a liquidity company, you likely won’t have any type of issues on Uniswap.

No registration required

If you’re tired of undergoing a lengthy signup procedure for crypto exchanges, Uniswap seems like a breath of fresh air. You do not need to offer personal info or develop an account. All you do is attach your crypto budget, and also you’re ready to trade or risk crypto.

Currently, the fact that Uniswap does not need any kind of personal information also has its drawbacks. You can not use it to buy crypto with fiat money, as well as there’s the possibility of regulative concerns. But from an ease as well as personal privacy point ofview, Uniswap is excellent.

Crypto wallet support

To utilize Uniswap, you link an Ethereum crypto budget. It sustains a lot of the most preferred crypto purses, consisting of Trust fund Pocketbook, MetaMask, as well as Coinbase Wallet, to name a few.

What could be improved

Doesn’t accept fiat money

Uniswap doesn’t allow you get crypto using fiat money, such as the united state buck. You should have crypto currently in a crypto purse that you attach to the exchange.

This is common among decentralized crypto exchanges, and it’s why several do not call for personal details on clients. It’s still a large hassle. Prior to you can use Uniswap, you require to get crypto somewhere else. Numerous users do so on an additional crypto exchange, transfer that crypto to a budget, and after that attach the pocketbook to Uniswap.

High gas charges

Gas fees are the transaction fees a blockchain costs. Uniswap is improved Ethereum. Because of Ethereum’s immense popularity, its blockchain has run into blockage, creating gas charges to boost. While Uniswap itself bills reduced costs, investors likewise pay Ethereum’s gas costs. These can be costly, especially on smaller deals.

As an example, gas charges are usually at least $30 to $50, depending upon then-current congestion. That’s regardless of the amount– so if you’re trading $1,000 well worth of crypto, it can set you back 3% or even more in gas charges. Trades of $100 or less aren’t worth it, due to the fact that gas costs can set you back 30% or even more.

Ethereum is transitioning to a proof-of-stake system, as well as one advantage is extra efficient transactions with much lower costs. However, for now, Uniswap is really only helpful for high-value deals.

Risk of evanescent loss when laying

Betting crypto in liquidity swimming pools is among the most amazing aspects of Uniswap– as opposed to just holding your crypto, you can make rate of interest and also grow your holdings. Several liquidity pools earn really high rates of interest, nevertheless, liquidity swimming pools likewise lug the threat of perishable loss. That’s when the worth of your crypto drops from the time you bet it in a liquidity swimming pool. If this occurs, you might lose money.

The risk of perishable loss is higher with even more volatile cryptocurrencies. These are often the cryptocurrencies where you can earn the most rate of interest, so it is very important not to choose the crypto you lay exclusively by the potential benefits.

No know-your-customer (KYC) process

Considering that it does not require developing an account, Uniswap doesn’t have a KYC process. Whether this is great or poor depends upon your point of view.

For investors that wish to maintain their tasks private, exchanges like Uniswap are optimal. The trouble is that exchanges without KYC are additionally most likely to encounter regulative concerns. Crypto lovers may appreciate confidential crypto trading, but their federal governments and tax authorities don’t.

The SEC launched an examination of Uniswap in 2021. Although the exchange hasn’t encountered legal concerns yet, it as well as various other decentralized exchanges without KYC could be first on the listing in the future.

Alternatives to think about

If you intend to buy crypto: Coinbase is just one of the most prominent centralized crypto exchanges, and it uses a fantastic option of cryptocurrencies. This exchange allows you transfer cash from your checking account for cryptocurrency acquisitions.

If you desire low costs: FTX exchange provides some of the most inexpensive crypto trading costs we have actually seen. While this exchange has different platforms for united state and worldwide clients, trading costs are competitive on both. Depositing cash from your bank account and acquiring crypto are additionally both extremely beginner-friendly on FTX.

Fees summary

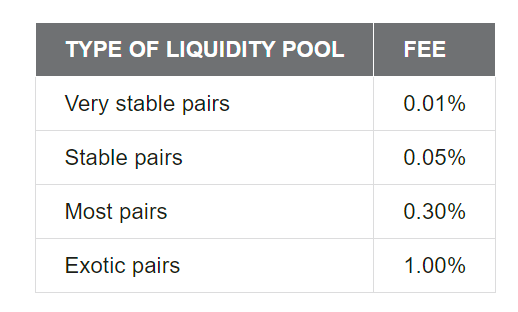

Uniswap charges a liquidity swimming pool cost on each trade. This charge is dispersed among the swimming pool’s liquidity service providers. It utilized to be a flat fee of 0.3%. With the launch of Uniswap V3, the exchange started establishing charge rates based upon the volatility of the liquidity pool.

You can follow latest uniswap news on twitter below:

Here are the fee tiers in Uniswap V3:

Pairs of stablecoins (cryptos pegged to the value of another possession) are generally in one of both most affordable charge tiers. A lot of crypto pairings are still in the 0.30% fee tier. Sets that consist of a couple of the extra unpredictable, risky cryptos remain in the most costly fee tier.

Uniswap’s charges are reasonable. The expensive component is the Ethereum gas costs. These aren’t a repaired quantity, as they differ depending on the degree of congestion and the type of transaction.

Cryptocurrency option

Any ERC-20 token can be traded on Uniswap. That indicates if a cryptocurrency is built on Ethereum, it’s either on Uniswap, or can be added by producing a liquidity pool as well as staking crypto funds.

Here are a few of the largest cryptocurrencies readily available on Uniswap:

- Ethereum (ETH)

- Uniswap (UNI)

- Tether (USDT)

- Polygon (MATIC)

- USD Coin (USDC)

- Shiba Inu (SHIB)

- Wrapped Bitcoin (WBTC)

- Chainlink (LINK)

- Dai (DAI)

- Fantom (FTM)

Considering That Bitcoin (BTC) isn’t improved Ethereum, it’s not on Uniswap. There is a wrapped variation offered, Covered Bitcoin (WBTC), which is a version built on Ethereum as well as created to mimic Bitcoin’s rate.

Is your cryptocurrency risk-free with Uniswap?

Your cryptocurrency should be safe with Uniswap, however there are specific threats you would not encounter on centralized exchanges.

For crypto trading, your funds aren’t saved on Uniswap whatsoever. You store them using your very own crypto pocketbook. This is different than merely keeping crypto on an exchange or with a stock broker, so there’s a little bit even more of a discovering contour. Eventually, you’re responsible for maintaining your crypto budget risk-free. Luckily, most quality wallets explain just how to do this.

The danger with Uniswap and exchanges like it is that any individual can add a token as well as start a liquidity pool. Several scammers have actually benefited from this with a maneuver called a “rug pull,” one of the reasons it’s so vital to very carefully research cryptos as well as liquidity pools before spending. Below’s just how a rug draw scam jobs:

A scammer produces a cryptocurrency token and also maintains a large section of the first token supply.

They start a liquidity pool for the token on a decentralized exchange. The liquidity swimming pool has the scam token as well as a major cryptocurrency, such as Ethereum.

They persuade individuals to buy their fraud token, typically via social media advertising and marketing.

When enough people have spent, the fraudster transforms their tokens to the other, a lot more well established cryptocurrency in the liquidity swimming pool.

The cost of the fraud cryptocurrency drops, leaving most financiers with nothing.

Make sure to watch uniswap tutorial and complete review video below:

Uniswap is right for you if:

You desire a simple means to trade crypto symbols.

Want leveraging crypto staking to grow your holdings.

Prepare to trade or bet $2,000 or more well worth of crypto at a time.