What is Hoo Exchange?

Hoo Exchange is a cryptocurrency exchange registered in Hong Kong. It has actually been up and running given that May 2018.

Chaince and OAX

A few of you may have come across the exchanges Chaince and also OAX. These were actually obtained by Hufu Technologies, the firm possessing the Hoo Exchange, and also combined right into the Hoo Exchange.

Trading Quantity

On the date of first creating this evaluation (7 August 2020), the platform mentioned on its web site that they sustained 212 different cryptocurrencies. This implies that a lot of the much more exotic altcoins are sustained below also. There are naturally two sides of the same coin here. On a positive note, a lot of supported cryptos indicates that even the most exotic altcoin investor can stay at this platform and also will certainly not need to look in other places to cater for all his/her certain trading needs. On the flip side, however, this could additionally indicate that there could be much more rip-off coins readily available for trading below. Exchanges with a smaller number of sustained cryptos generally just sustain the bigger crypto tasks, which have actually all undergone various due diligence processes and that are– in many cases– correctly vetted. A newly released altcoin has actually not been subject to the same scrutiny.

On the same date, the platform stated that its 24-hour trading volume was approx. USD 615 million (USD 615.17 million). We have actually not been able to confirm this trading quantity, yet if it is correct, it is an extremely excellent trading quantity and also shows that the individuals of this system do not need to worry about liquidity concerns.

Nevertheless, on the date of last upgrading this evaluation (2 December 2021), the trading quantity was USD 320 million.

Hoo Exchange Mobile Assistance

Most crypto traders really feel that desktop offer the very best problems for their trading. The computer has a bigger display, and also on larger displays, even more of the important details that most traders base their trading choices on can be checked out at the same time. The trading graph will likewise be less complicated to display. However, not all crypto financiers require desktops for their trading. Some favor to do their crypto trading via their mobile phone. If you are one of those traders, you’ll more than happy to discover that Hoo Exchange’s trading platform is also mobile compatible. You can download it to/from both the AppStore as well as Google Play:

Leveraged Trading

Hoo Exchange likewise offers leveraged trading to its users. As for we can tell, they only offer perpetuals (i.e. futures without expiration dates). The maximum take advantage of degree for their perpetuals is 100x (i.e. one hundred times the pertinent quantity). Alternative exchange for you could be Bybit or Kucoin.

A word of care may be helpful for somebody considering leveraged trading. Leveraged trading can lead to massive returns but– on the other hand– likewise to similarly large losses.

For instance, let’s state that you have 10,000 USD on your trading account and also bet 100 USD on BTC going long (i.e., enhancing in value). You do so with 100x leverage. If BTC then enhances in worth with 10%, if you had only wager 100 USD, you would certainly have earned 10 USD if you merely held Bitcoin. Now, as you wager 100 USD with 100x utilize, you have actually instead gained an additional 1,000 USD (990 USD greater than if you had not leveraged your deal). On the other hand, if BTC decreases in worth with 10%, you have actually shed 1,000 USD (990 USD greater than if you had not leveraged your deal). So, as you could picture, there is possibility for huge benefit however additionally for massive disadvantage …

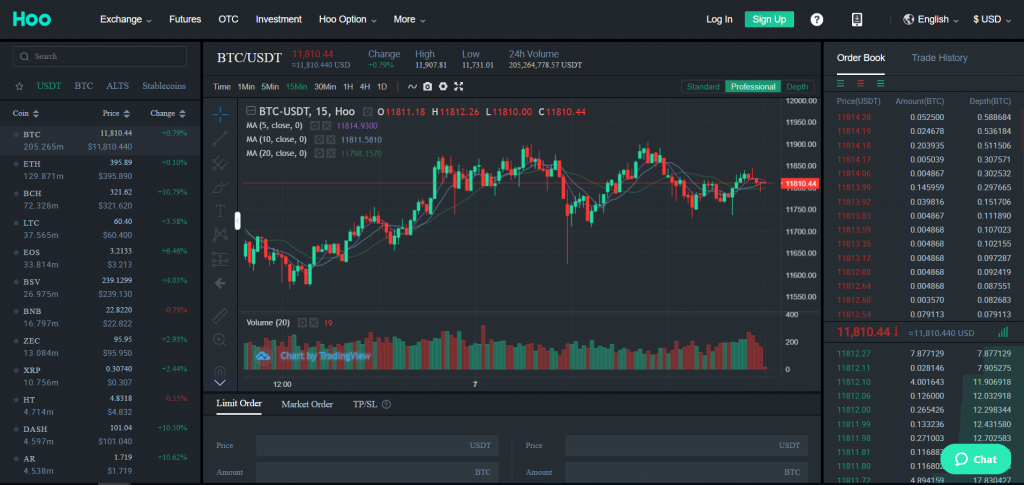

Hoo Exchange Trading View

Every trading platform has a trading sight. The trading sight is the part of the exchange’s site where you can see the price chart of a certain cryptocurrency and what its present cost is. There are typically likewise deal boxes, where you can place orders relative to the pertinent crypto, and, at most systems, you will likewise have the ability to see the order background (i.e., previous deals including the relevant crypto). Everything in the exact same view on your desktop. There are obviously additionally variants to what we have now defined. This is the trading sight at Hoo Exchange:

It depends on you– and only you– to choose if the above trading sight appropriates to you. Lastly, there are usually many different methods which you can change the setups to customize the trading view after your very own preferences.

OTC-desk

Let’s state that you hold a large amount of a particular cryptocurrency. You want to offer that amount. Should you do that on a regular trading platform like everybody else? Perhaps not. Among numerous factors for executing big professions outside of the normal market place is that large professions might affect the market cost of the relevant crypto. One more factor, which is attached to the foregoing, is that the order book may be too thin to execute the appropriate trade. An option to these problems is what we call OTC-trading (Over The Counter).

Hoo Exchange provides OTC-trading, which might be useful to all the “whales” around (and maybe likewise to all the “dolphins”).

US-investors

Why do so several exchanges not enable United States people to charge account with them? The solution has only 3 letters. S, E and also C (the Stocks Exchange Payment). The reason the SEC is so frightening is because the US does not permit foreign firms to get US financiers, unless those foreign business are additionally registered in the United States (with the SEC). If foreign firms get US capitalists anyway, the SEC can sue them. There are lots of instances of when the SEC has actually filed a claim against crypto exchanges, among which being when they sued EtherDelta for operating an unregistered exchange. An additional instance was when they sued Bitfinex as well as asserted that the stablecoin Tether (USDT) was deceptive investors. It is very likely that even more cases will adhere to.

It is uncertain whether Hoo Exchange permits United States financiers or not. We have reviewed their Conditions as well as have actually not located an explicit restriction people financiers. We prompt any type of United States capitalists to form their own viewpoint on the permissibility of their trading at Hoo Exchange though.

Hoo Exchange Fees

Hoo Exchange Trading fees

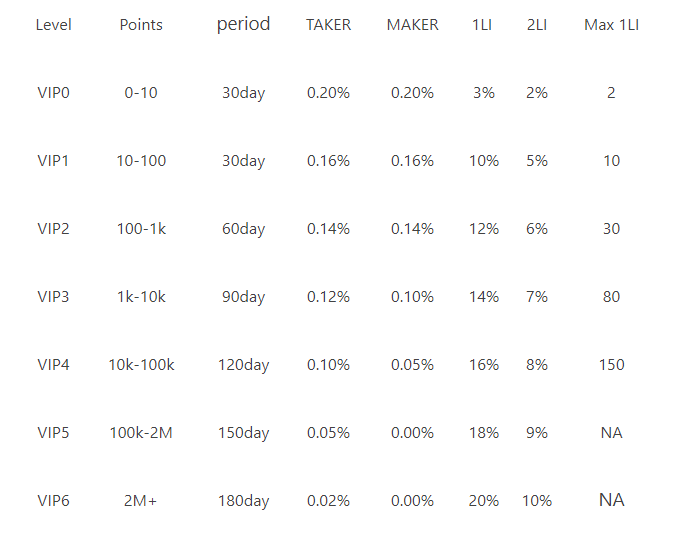

Each time you position an order, the exchange fees you a trading cost. The trading charge is usually a portion of the worth of the profession order. Several exchanges divide between takers and makers. Takers are the one that “take” an existing order from the order publication. Makers are the ones that add orders to the order publication, thus making liquidity at the system.

Hoo Exchange charges what we call level fees, meaning that both the takers and the makers pay the very same fee: 0.20%. These taker charges are somewhat above the international industry standards for centralized exchanges. Sure, industry averages have historically been around 0.20-0.25% but we now see new market standards emerging around 0.10% -0.15%.

Hoo Exchange likewise supplies trading cost discounts to its VIP-customer. You become a VIP-customer by racking up points. You score points by either achieving a particular trading quantity, or by welcoming a lot of good friends who develop accounts at the platform. Please describe Hoo Exchange’s website for even more info on this. Here are the available trading charge discount rates:

Hoo Exchange Withdrawal fees

To our understanding, Hoo Exchange does not bill any kind of charges of their own when you take out crypto from your account at the platform. As necessary, the only fee you need to consider when taking out are the network fees. The network costs are charges paid to the miners of the appropriate crypto/blockchain, and not costs paid to the exchange itself. Network costs vary from day to day depending upon the network pressure. As a whole however, only paying the network charges must be taken into consideration as below international sector standard when it involves fee levels for crypto withdrawals.

You can follow Hoo exchange news on twitter below:

Down payment Techniques

In addition to transferring cryptocurrency to the platform, Hoo Exchange additionally allows you down payment fiat money. Nonetheless, just with cord transfer (not credit or debit card). Seeing as fiat money deposits are possible at this trading system, this system certifies as an “entry-level exchange”, making it an exchange where new crypto capitalists can start their trip right into the amazing crypto globe.

Hoo’s associate program

The Hoo crypto exchange offers a non-standard referral program. To participate in the program, make use of the specific affiliate link that is readily available in your personal account. You can publish it on any type of site.

Each customer that comes through your associate web link and is signed up and also validated on the exchange will certainly become your first-level partner. Your second-level partner will be every user who is invited to the exchange by your first-level companion. The number of partners is not limited. You can get the adhering to rewards for companions:

50 points for registration/verification of a first-level partner (the partner additionally receives 50 points);.

from 3% from all fees of a first-level companion for trading operations;.

from 2% from all costs of a second-level partner for trading procedures.

Payouts increase as your trading level rises. Along with repayments, you obtain points. Factors enhance your trading degree. The greater the trading degree, the lower the system compensation for you. You likewise obtain points for energetic trading.

Discount and Discount Programs of the Traders Union for Hoo.

The Hoo crypto exchange permits you to minimize payment charges not only through gaining points and increasing trading volume. You can likewise lower them by utilizing bonus offers in the form of discounts from Traders Union based upon the return of part of the costs. To do this, you have to first register on the website of the Traders Union, after that adhere to the affiliate web link to the crypto exchange website, register, and also open up a trading account. Next, enter the number of this account in the “Accounts” area of your personal account on the Traders Union site, and start trading. From the moment the account is validated by the Traders Union experts, the rebates will be paid on a monthly basis.

Below you can watch video detailed review on Hoo exchange:

Try it! You’ll like this!

Final thought.

On the Hoo exchange, you can productively trade and also trade cryptocurrencies. For spending and also easy revenues, there is laying, mining, and also a two-level recommendation program. Compensation costs are below par for the segment. There is mobile trading. The disadvantages are: no demo accounts, overviews, call center, and also couple of money. Additionally, regular system failures have actually been reported. There is no open information on the certificate.