What is C-Trade?

C-Trade is a cryptocurrency exchange signed up in the Seychelles. It has actually been active given that 2020.

This exchange is a so called by-products exchange, implying that they concentrate on derivatives trading. The system does however support spot trading too, so if that’s your choice, this platform can still be for you. A derivative is a tool priced based on the worth of an additional possession (normally stocks, bonds, commodities and so on). In the cryptocurrency globe, by-products appropriately acquire its worths from the costs of details cryptocurrencies.

You can engage in by-products trading attached to Bitcoin, Ethereum, Litecoin, Surge, Binance Coin and Bitcoin Cash here.

Affiliate Program

C-Trade also has an affiliate program. Via this program, you can earn approximately 40% compensations on C-Trade’s trading fees produced from the futures and also area trading of your referrals. 40% is an appealing compensation degree about the market criteria.

Leveraged Trading

C-Trade additionally offers leveraged trading to its customers. They just provide perpetuals (i.e., futures without expiration days), as well as no futures with expiration dates. The optimum leverage degree for their perpetuals is 150x. A word of care might be valuable for somebody pondering leveraged trading. Leveraged trading can cause massive returns however– on the other hand– additionally to similarly substantial losses.

As an example, let’s say that you have 100 USD in your trading account and also you wager this amount on BTC going long (i.e., rising in value). If BTC after that enhances in value with 10%, you would have gained 10 USD. If you had actually utilized 100x utilize, your first 100 USD setting ends up being a 10,000 USD placement so you rather earn an additional 1,000 USD (990 USD greater than if you had not leveraged your offer). However, the even more take advantage of you utilize, the smaller sized the distance to your liquidation price ends up being. This implies that if the cost of BTC moves in the contrary instructions (drops for this example), then it only needs to decrease a really small portion for you to lose the entire 100 USD you started with. Once again, the more leverage you use, the smaller the contrary rate activity needs to be for you to shed your investment. So, as you might picture, the balance in between risk as well as benefit in leveraged bargains is fairly fine-tuned (there are no threat complimentary revenues).

Mobile Support

Many crypto traders feel that desktop offer the very best problems for their trading. The computer has a bigger display, and also on bigger screens, more of the critical info that most investors base their trading choices on can be checked out at the same time. The trading chart will also be simpler to show. Nevertheless, not all crypto financiers need desktops for their trading. Some like to do their crypto trading through their cellphone. If you are just one of those traders, you’ll enjoy to find out that C-Trades’s trading system is also offered as an application for iPhone as well as Android individuals.

US-investors

Why do so numerous exchanges not enable US people to open accounts with them? The answer has only three letters. S, E and C (the Stocks Exchange Commission). The reason the SEC is so frightening is since the United States does not permit foreign business to get US investors, unless those foreign companies are also signed up in the United States (with the SEC). If foreign business solicit United States investors anyway, the SEC can sue them. There are numerous examples of when the SEC has actually taken legal action against crypto exchanges, among which being when they filed a claim against EtherDelta for running an unregistered exchange. An additional instance was when they took legal action against Bitfinex and asserted that the stablecoin Tether (USDT) was deceptive financiers. It is highly likely that more situations will comply with.

C-Trade does not enable US-investors on its exchange. So if you’re from the US and wants to engage in crypto trading, you will have to look somewhere else. Thankfully for you, if you most likely to the Exchange Listing as well as use our exchange filters, you can sort the exchanges based on whether or not they accept US-investors.

C-Trade official twitter to follow news below:

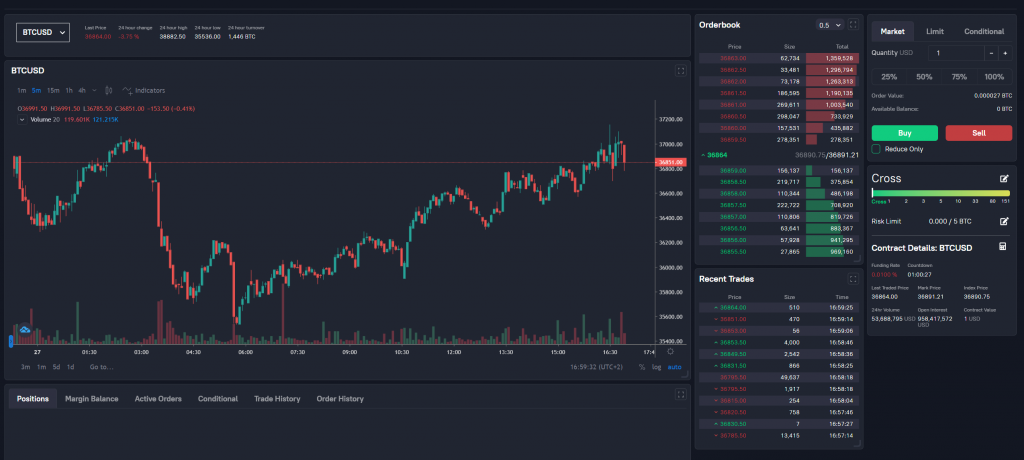

C-Trade Trading View

Every trading platform has a trading view. The trading view is the part of the exchange’s site where you can see the price graph of a certain cryptocurrency as well as what its present price is. There are usually likewise buy and sell boxes, where you can position orders with respect to the appropriate crypto, as well as, at most platforms, you will also have the ability to see the order history (i.e., previous purchases involving the pertinent crypto). Everything in the same sight on your desktop computer. There are naturally likewise variants to what we have now explained. Alternative exchange Phemex.

This is the trading sight at C-Trade (when not checked in):

It is up to you– and also only you– to determine if the above trading sight appropriates to you. Finally, there are usually many different methods which you can transform the settings to tailor the trading view after your really own preferences.

Continuous contracts.

Continuous contracts are financial derivative contracts that can be utilized for an indefinite period of time due to the fact that they do not have an expiration date. Perpetual contracts are becoming progressively popular in the crypto world because they allow traders to maintain their utilize placement for as long as feasible.

C-Trade USDT perpetual agreement is a linear contract, and it makes use of a USDT margin. The P&L estimation is represented by a straight contour on the chart. USDT continuous agreements use stablecoin as margin, unlike inverse continuous contracts that make use of the underlying cryptocurrency.

Min. order amount for BTC/USDT is 0.001 BTC, and 1000 BTC is max. order quantity.

For ETH/USDT, minutes. is 0.01 ETH, and also max. is 1000 ETH.

C-Trade sustained coins.

In the meantime, C-Trade supports 5 cryptocurrencies: Bitcoin (BTC), Ethereum (ETH), Surge (XRP), Dogecoin (DOGE), and also Tether (USDT), yet there are efforts to introduce other coins in the near future.

C-Trade Costs.

C-Trade Trading costs.

Every time you put an order, the exchange fees you a trading fee. The trading fee is typically a percentage of the value of the trade order. Several exchanges divide in between takers and also manufacturers. Takers are the one who “take” an existing order from the order book. Makers are the ones who include orders to the order book, thereby making liquidity at the system.

At C-Trade, takers are billed 0.075% per order. When it involves the makers, their fee is -0.025%. This essentially suggests that each manufacturer earn money to trade. To make clear, allow’s state that you are the manufacturer in an order where you buy cryptocurrency for USD 1,000. This means that as opposed to paying USD 1,000, you will only need to pay USD 997.50. This is a very affordable trait without a doubt.

According to the most comprehensive market report ever prepared on agreement trading average costs, the international average agreements trading taker cost as well as manufacturer charge was 0.063% for takers as well as 0.018% for manufacturers. As necessary, C-Trade is somewhat above average when it pertains to its taker charges however significantly below par with respect to manufacturer charges. Overall, the costs below are appealing.

C-Trade Withdrawal fees.

There are exchanges around that charge reduced trading charges but then strike you on your way out with high withdrawal charges. This exchange, nevertheless, just charges the network charges when you do a transaction.

According to the current empirical research that we have carried out on Cryptowisser.com, the international sector BTC-withdrawal cost is 0.00053 BTC per withdrawal. The network charges vary daily but are generally less than the worldwide industry average BTC-withdrawal charge.

Consequently, the withdrawal fees you need to fret about when taking out from C-Trade are reasonably low and also customer friendly.

C-Trade supported countries.

C-Trade sustains profession from mostly all countries, except in 2 instances.

The initial of them is if the nation belongs to the FATF (Monetary Activity Task Force) checklist or it is marked as a high-risk country. A few of these countries are Afghanistan, Turkey, Cuba, Albania, Morocco, Panama, Haiti, the Autonomous Individuals’s Republic of Korea, etc. There is a full list on C-Trade’s internet site.

The second case is if you are a United States citizen. It’s prohibited for United States investors to charge account on C-Trade. Below you will read why.

Deposit Methods

In order to trade right here, you need to have cryptocurrency to start with. The only asset class you can transfer to C-Trade is cryptocurrency. However, if you truly like C-Trade yet you do not have any crypto yet, you can easily start an account with an exchange that has “fiat on-ramps” (an exchange where you can deposit regular cash money), acquire crypto there, and after that transfer it from such exchange to this exchange. Utilize our Exchange Filters to easily see which systems that allow wire transfer or charge card down payments.

Final thoughts

Besides the above, we can agree that C-Trade is a system that satisfies customers’ standards in nearly all facets. Given that it is relatively recent, it is required to deal with boosting solutions in order to stick out amongst the competitors. The only significant complaint is that there are only 5 coins they deal with, however we hope that they will expand to others.

All in all, C-Trade is something that is recommended to customers of crypto services.