BlockFi uses a cryptocurrency exchange, interest-bearing accounts, and low-interest-rate finances worldwide. There are no purchase costs on professions, and also you won’t need to worry about hidden charges or minimum balances. Read our BlockFi testimonial for a summary of the firm’s trading, conserving, and borrowing options and also prices.

This cryptocurrency system is an excellent fit for: Novice and also intermediate cryptocurrency capitalists who want to bridge the gap in between typical finance and crypto.

Pros

- U.S.-based and regulated

- Instant trades

- No commission fee

- No monthly fees or minimum deposits

- Available worldwide, except sanctioned or watch-listed countries

Cons

- No joint or custodial accounts

- Limited free withdrawals from interest accounts

- APY and loan rate volatility

- Savings aren’t protected against bank failure

Alternatives to take into consideration

If you want to take care of crypto trading as well as united state stock trading in one system: Robinhood is a popular financial investment app that introduced in 2015. It allows you sell 17 cryptocurrencies with absolutely no payment charges.

If you just wish to meddle Bitcoin: Check out the Cash Money Application by Square. Best understood for person-to-person settlements, it also includes a supply trading system and also you can purchase, offer, and profession Bitcoin.

Top perks

Make passion on your holdings

With a BlockFi Rate Of Interest Account, you can gain between 3% and also 8.6% intensifying rate of interest on your cryptocurrency holdings. The account has no covert fees and also no minimum balance requirement.

The rates of interest differs by money type as well as varies with market price. Interest builds up day-to-day as well as is added to your account monthly– so you’ll earn interest on your interest every month. The Passion Settlement Flex alternative allows you select the money your passion is paid in.

U.S. capitalists will obtain a 1099 from BlockFi at the end of each year mentioning just how much interest they received. International clients are responsible for managing their very own tax obligation liability.

Obtain versus your portfolio

Avoid selling your crypto when you need money. BlockFilets you borrow funds in USD against your crypto possessions with rate of interest as reduced as 4.5%.

Borrowing instead of offering means you do not have to report capital gains, which could save you money in tax obligations. Plus, the interest could be tax obligation deductible, decreasing your tax obligation bill also additionally.

Note: One danger of obtaining this way is that you can shed your security– your crypto assets– if crypto prices drop. It would certainly mean you no longer have sufficient value in your interest account to sustain your car loan balance.

Rewards credit card

BlockFi is the first firm to introduce a Bitcoin rewards charge card, a Visa charge card that gains 1.5% back in bitcoin on acquisitions. Your Bitcoin benefits will be included in your BlockFi Rate Of Interest Account, so it gains passion right away.

It’s not yet offered, but you can sign up with the waiting list to use when cards start shipping in springtime 2021. Applications are subject to credit rating authorization. Early applicants will have additional chances to earn even more bitcoin with the card.

U.S.-based and also controlled firm

BlockFi is one of couple of crypto exchanges based in the USA. Its custodian, Gemini, is controlled by the New York State Department of Financial Services.

BlockFi hasn’t relied on an ICO (capitalist offering) or energy symbols for financing. Instead, it pays a steady rates of interest by making through its borrowing items.

Automatic trading

When you have funds in your BlockFi Passion Account, you can establish recurring trades. These can automatically buy cryptocurrencies daily, weekly, or monthly. That way, your account can grow in value as well as gain rate of interest even if you don’t invest much time actively trading.

What could be improved

Restricted cost-free withdrawals

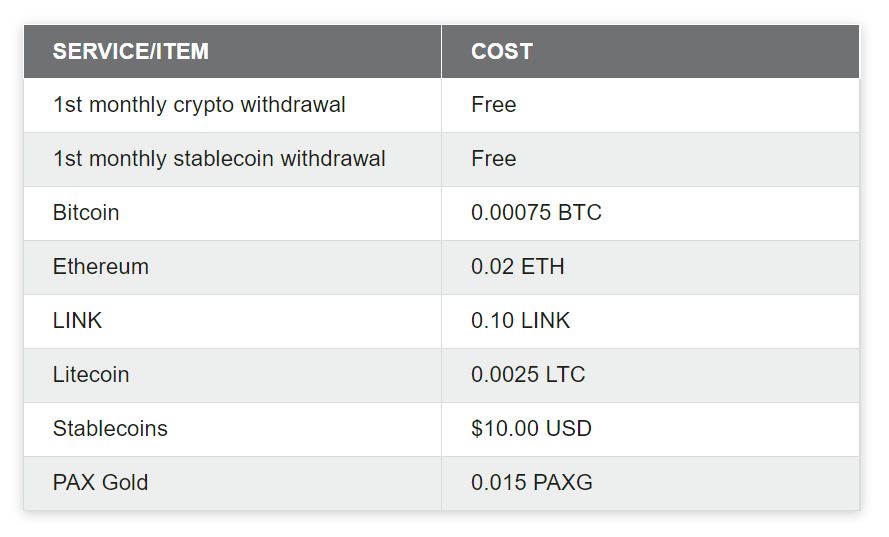

You can make one free crypto withdrawal and one complimentary stablecoin withdrawal per month. Past that, you’ll pay a charge for each withdrawal, which differs by currency.

No custodial accounts

Many capitalists are aiming to cryptocurrencies to protect lasting financial investments versus inflation. In spite of the volatility of these currencies, they could be an eye-catching option to save for college or other savings plans for kids.

Custodial accounts– kept in a grownup’s name that transfers to a child when they transform 18– aren’t common in crypto exchanges. BlockFi doesn’t use one, yet it states it intends to in the future.

There’s technically no adultness to get or have cryptocurrencies anywhere in the globe. But exchanges in many nations, including BlockFi, call for users to be 18 years of ages or older. This makes it challenging for kids to make use of the prospective long-term financial savings advantages of cryptocurrency financial investments.

Exactly how BlockFi works

BlockFi is a cryptocurrency exchange and pocketbook that serves people and services worldwide. It offers an interest-earning account, portfolio-backed lendings, and fee-free trading.

Just like much of the very best cryptocurrency exchanges, you can fund your account with USD, crypto, or stablecoins.

BlockFi Rate Of Interest Account

This interest-bearing account holds coins you have actually deposited or acquired on the exchange. It works just like a standard savings or financial investment account. One big difference is that cash you put in a checking account would certainly be secured up to $250,000 versus financial institution failing through FDIC insurance. In a similar way, any type of money in a broker agent account would certainly be secured by SIPC insurance coverage. However if you place your cost savings right into a BlockFi Passion Account, you don’t have these defenses.

You’re restricted to one crypto withdrawal and one stablecoin withdrawal each month. After that, you’ll pay a cost for every withdrawal. You can make automated transfers to any bank account connected to Plaid, a business that enables applications to firmly move data to and also from your financial institution.

You can also establish a business or business account. It works similarly as a specific BlockFi Interest Account but is in the entity’s name. It calls for extra paperwork and a much longer confirmation procedure. When you use, a participant of BlockFi’s conformity team will contact you to assist with the remainder of the sign-up process.

It pays these rates of interest:

Bitcoin (as much as 2.5 BTC): 6%.

Bitcoin (greater than 2.5 BTC): 3%.

Ethereum: 5.25%.

WEB LINK: 5.5%.

PAX Gold: 5%.

Litecoin: 6.5%.

Paxos Requirement: 8.6%.

USDt: 9.3%.

USDC, GUSD, and BUSD: 8.6%.

Rate of interest begins to build up the day after you deposit and compounds monthly.

BlockFi pays rate of interest by providing properties to institutional and also business customers with high security. It stores books– so it can money your withdrawals– with New York trust company, Gemini, and also various other third parties.

The BlockFi Passion Account is available to customers in most countries and in all united state states except New york city.

You can follow Blockfi official announcements at twitter below:

BlockFi Trading.

Use funds from your BlockFi Rate of interest Account to purchase cryptocurrency on BlockFi’s exchange without charges. You’ll have daily trading limitations based upon your account dimension and also activity.

To make a profession, just log into your BlockFi account, and go into the buy or market amount and also currencies, as well as authorize the trade. You can make a single trade, or automate the trade to recur daily, weekly, or monthly.

When you buy crypto on the exchange, it’ll land in your Rate of interest Account and start to make interest right away.

Crypto-backed lendings.

Use a BlockFi finance like an individual financing to money major acquisitions, re-finance debt, or make a down payment on a residence.

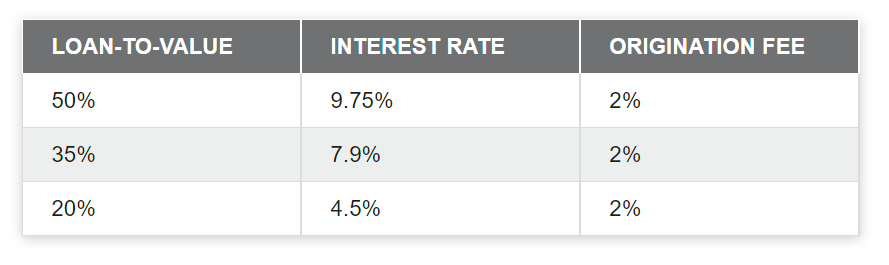

You have to use crypto properties to back the loan with a loan-to-value (LTV) proportion of a minimum of 50% (implying your collateral is worth at the very least half of what you owe). You can borrow in USD, GUSD, or USDC; as well as install collateral in Bitcoin, Ethereum, or Litecoin.

You’ll pay a 2% origination charge to obtain your lending, and also pay interest between 4.5% and 9.75%, depending upon your LTV.

Costs introduction.

BlockFi doesn’t bill transaction charges for trading on its exchange. You’ll pay charges to withdraw funds from your account more than twice each month. Also, you’ll pay source fees and also rate of interest on crypto-backed fundings you borrow through the company.

Withdrawal charges.

BlockFi permits one free crypto withdrawal and also one cost-free stablecoin withdrawal each month. Afterwards, you’ll pay a fee per withdrawal based upon currency.

Financing prices and also charges.

Cryptocurrency option.

BlockFi sustains 6 popular cryptocurrencies, including Bitcoin as well as Ethereum, and also four stablecoins, including USDC as well as GUSD, the native currency of its custodian, Gemini.

- Bitcoin (BTC)

- LINK (LINK)

- Ethereum (ETH)

- Litecoin (LTC)

- Paxos Standard (PAX)

- PAX Gold (PAXG)

- USD Coin (USDC)

- Gemini dollar (GUSD)

- Tether (USDt)

- Binance USD (BUSD)

Is your cryptocurrency secure with BlockFi?

BlockFi is among couple of U.S.-based crypto exchanges as well as it runs within united state government as well as state laws. Nevertheless, as we talked about above, like all crypto possessions, funds in a BlockFi account are not insured by the FDIC or SPIC.

BlockFi uses numerous safety and security measures to safeguard your properties and make sure funds are readily available:.

It keeps books with 3rd parties, including Gemini, BitGo, and also Coinbase.

It buys SEC-regulated equities as well as CFTC-regulated futures– i.e. financial investments controlled by the U.S. federal government.

It offers thoroughly, with lendings backed by as much as 50% collateral.

In addition to its state-regulated custodian, BlockFi is backed by reputable investors. These include Valar Ventures, Morgan Creek Funding Management, Coinbase Ventures, as well as extra.

BlockFi allows you choose into something called allowlisting. This is a self-service safety and security attribute that permits you to ban withdrawals or limit them to specific addresses. This security action helps protect against burglary from your BlockFi account.

Considering Coinbase? See Coinbase detailed review.

BlockFi is right for you if:.

You’re a beginner or intermediate cryptocurrency financier.

You’re open to raised regulation for higher safety and security.

You’re trying to find an individual or business account.

You want to earn passion on your crypto holdings.

You want simple accessibility to portfolio-backed loans to keep liquidity without incurring resources gains tax obligations.